One of the most impressive strategic moves in recent times in the Industrial Bakery market in the Americas was definitely the launch by the company Bauducco, of breads with 85 days of validity, or Hyper validity breads, as we named internally at PMAN. This release has broken many paradigms and is changing the market as a whole.

Figure 1: Photo of Bauducco breads in a supermarket in Santiago, Chile

Figure 2: Photo of Bauducco breads in a supermarket in Rio Branco – Acre, between two shelves of local manufacturers in Acre.

Figure 2: Photo of Bauducco breads in a supermarket in Rio Branco – Acre, between two shelves of local manufacturers in Acre.

Bauducco is a traditional Panettone manufacturer, in addition to other products such as biscuits; it has a vast distribution network and a geographic coverage of national sales, in addition to being an important exporter.

Bauducco is a traditional Panettone manufacturer, in addition to other products such as biscuits; it has a vast distribution network and a geographic coverage of national sales, in addition to being an important exporter.

The industrial bakery market traditionally works with shelf life that varies between 11 and 18 days, depending on the level of contamination in the factory and the combination of barriers against mold installed.

The sector’s logistics are intensive; bread deliveries are made 2, 3, 4 times a week to customers such as small, medium and large supermarkets. Logistics expenses can cost 8% of the expenses of bakery companies; the fleet is normally its own.

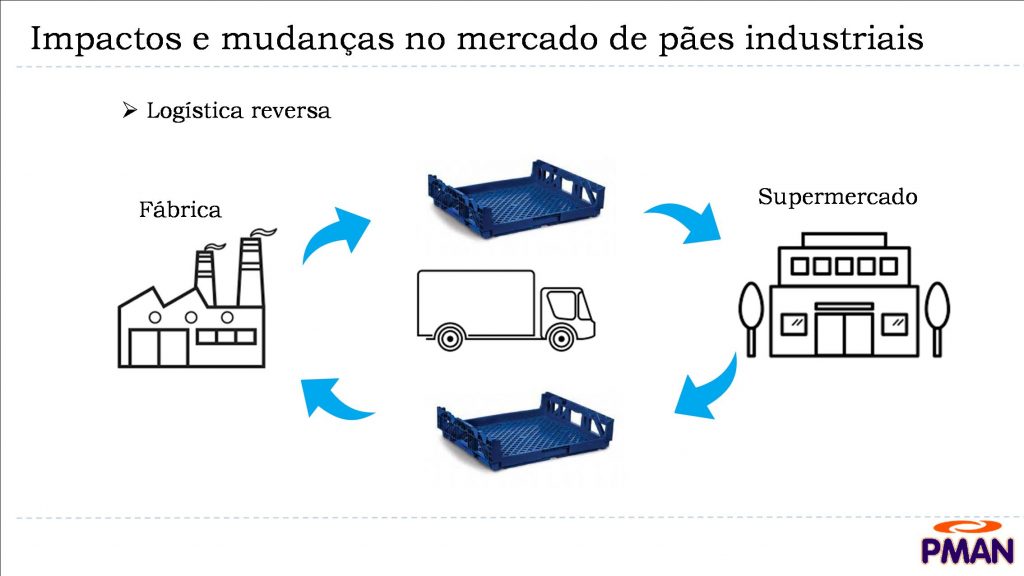

In addition, it is necessary to work with reverse logistics, that is, bread not sold in supermarkets within 5 days before expiration must be removed from the shelves, replaced by bread with longer validity; the sector’s average returns are 7.5% of the volume of bread sold, but in companies with low shelf life or even mold problems, it can reach up to 20% in the most critical cases.

Impactos e mudanças no mercado de pães industriais = Impacts and changes in the industrial bread market

Logística reversa = Reverse logistic

Supermercado = Supermarket

Figure 3: Demonstration of the Traditional Logistic Scheme of a Pão de Forma company

Companies work with returnable plastic boxes, as it was understood until the launch of the Bauducco bread line that non-returnable cardboard boxes were very expensive; these same boxes are usually misplaced and invariably stolen and still need to be sanitized to enable use in the next delivery. Furthermore, these same boxes end up hindering the productivity of the bread companies, because when they do not return to the manufacturers in time, they make it impossible to deliver the new breads that have been manufactured and sold.

Companies work with returnable plastic boxes, as it was understood until the launch of the Bauducco bread line that non-returnable cardboard boxes were very expensive; these same boxes are usually misplaced and invariably stolen and still need to be sanitized to enable use in the next delivery. Furthermore, these same boxes end up hindering the productivity of the bread companies, because when they do not return to the manufacturers in time, they make it impossible to deliver the new breads that have been manufactured and sold.

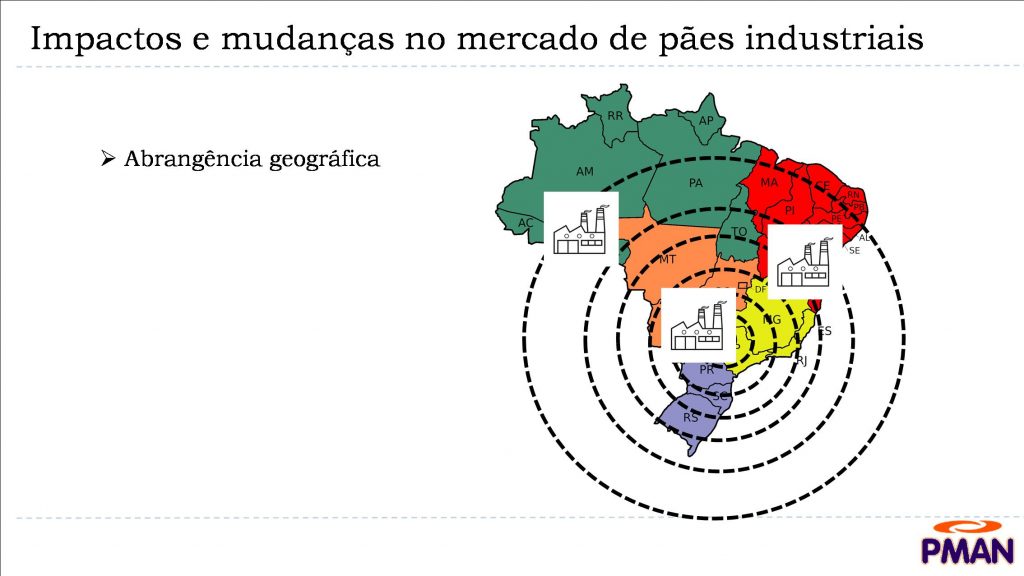

The geographic coverage of sales, in companies with greater validity, rarely reaches or exceeds 1,000 km from the factory; in smaller companies it doesn’t reach 50km from the manufacturing point.

Abrangência geográfica = Geographic scope

Impactos e mudanças no mercado de paes industriais = Impacts and changes in the industrial country market

Figure 4: Demonstration of the Traditional “Site Location” Scheme of a Pão de Forma company

Investments in factories are high, to compensate for the low geographic coverage, forcing the largest manufacturers to have several factories installed in the countries where they operate. With several factories installed, there is a need to maintain administrative structures and overhead for decentralized production control.

Investments in factories are high, to compensate for the low geographic coverage, forcing the largest manufacturers to have several factories installed in the countries where they operate. With several factories installed, there is a need to maintain administrative structures and overhead for decentralized production control.

All these STRATEGIC paradigms were broken with the launch of hypervalidity buns;

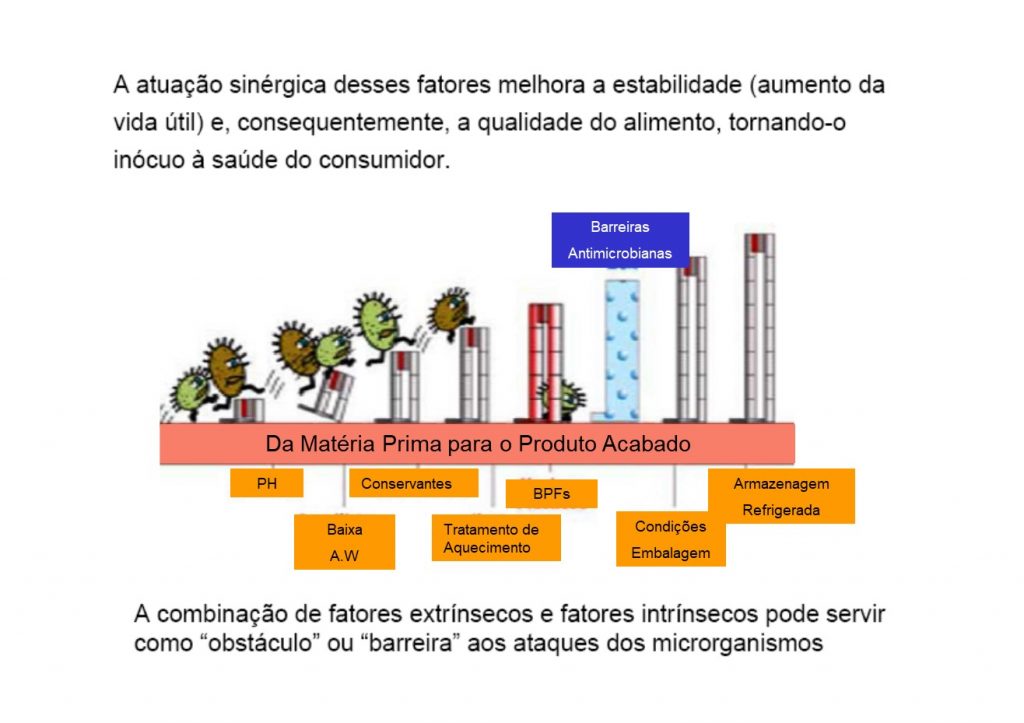

We emphasize the word STRATEGIC, because with this article, we want to demonstrate the immense correlation between the validity of breads and the strategy to be adopted in an industrialized bread company. When talking about shelf life or Shelf Life or shelf life in a bread company, we are no longer talking about ingredients, quality control techniques of raw materials or the degree of contamination of factories, but about strategy; depending on each company’s strategy, different barriers need to be installed and combined;

Da matéria prima para o produto acabado = From raw material to finished product

Da matéria prima para o produto acabado = From raw material to finished product

PH = PH

Conservantes = Preservatives

BPFS = BPDFS

Armazenagem refrigerada = Cold storage

Condições da embalagem = Packaging conditions

Tratamento de aquecimento= Heating treatment

Baixa A.W. = Low A.W.

In the famous picture above, we see the little “molds” jumping over the barriers to try to get to their food: they are living beings and they need water, oxygen and food; its food is, for example, breads, pizzas, cakes, Panettone and other baked products; the obstacles symbolize the barriers: PH (controlled by acidulants), AW (water activity), Preservatives (internal and external), Heating Treatment (in this case the bakery oven), GMPs (Good Manufacturing Practices), Conditions of Packing and Refrigerated Storage.

Each of these barriers contributes as an additional obstacle to making it difficult for the “moulds” to reach the food; here comes the correlation between the Company’s Strategy and the Expected Shelf Life:

Sales Outreach Strategy vs. Shelf Life: the greater the geographic coverage, the more barriers need to be installed to increase Shelf Life; on the other hand, if a company’s sales are not nationwide, it makes no sense to spend with many barriers:

National or International Level: If a company has a National Sales Coverage (and in the case of Brazil, our country is almost a continent), or sometimes International (notice in Figure 1 with the photo of Bauducco’s breads; the labels are in Spanish, and the breads are manufactured in southeastern Brazil and reach Chile – approximately 4,000km distance between the Factory and the point of sale), or in Figure 2 where we show Bauducco’s breads in Acre, which have a similar distance; in this case, many barriers are necessary to reach the necessary shelf life for a loaf to run 4,000 km + sales turnover time in all existing channels (distributors, supermarkets) + safe consumption time at the consumer’s home.

State level: if a company has a Sales Coverage at the State level (and in the case of Brazil we must analyze it case by case because depending on the State, the number of kilometers traveled can surpass many countries) the barriers can be lower, requiring less financial investments.

City level: if a company has a Sales Scope at the Municipal Level, the barriers can be even lower and therefore the respective investments in barriers.

Note that the competition will no longer be the same; companies that were “protected”, they lost the geographical protection that distance imposed;

Also note that companies will need adjust your barriers according to the established strategy, acting at the municipal level, or the sum of some municipalities, or at the State, National and finally international level.

Observe that Packaging Strategy tends to migrate from traditional plastic boxes, returnables and high costs of reverse logistics to cardboard boxes;

Observe that Delivery Frequency tends to fall, from 3 to 4 times a week to once a month or even bimonthly, passing the responsibility for storage and distribution to distributors who share the logistical expenses with several products;

Observe that returns tend to fall, because with the longer shelf life, almost all of the bread will be sold on the shelf before expiration.

Note that the Logistics Strategy will change drastically in the processed bread sector: it is no longer necessary to have an own distribution fleet; you can work with autonomous distributors.

Observe that expenses will migrate between the various accounting items, depending on the strategy adopted, but without increasing the final expense for the consumer, even reducing costs in relation to those currently practiced.

Finally, note that hypervalidity will allow the entry of new players who never thought of operating in the bread market, such as mills, biscuit companies, Panettone, ready-to-eat meals, pasta and other products that enable cross-selling.

Conclusion: the best combination of barriers is the one that provides gradual cost increases, as it is very difficult for a company to move from a Municipal to an International scope in a single movement, unless it already has a pre-established scope through other products.

PMAN is expert on this subject and you will be able to guide your business in the best way, with customized solutions for each company. Count on us!

Paulo R Cavalcante – PMAN Director